brianladd.online

Market

Business Credit Card Balance Transfer Uk

Barclaycard Platinum up to 28 month balance transfer card. 0% interest on balance transfers for up to 28 months. From the date you open your account. Transfers. For example, as HSBC, First Direct, M&S Bank and John Lewis are all part of the HSBC Banking Group, you would not be able to transfer balances between these. Save money by transferring higher rate credit card balances. Credit Card. Our balance transfer credit card. Credit Card. Up to £8, credit limit. Maximum 3. A 0% balance transfer credit card offers an introductory interest rate of 0% for a set period of time. You can transfer a balance from an. Explore Chase balance transfer credit cards to save money and pay off your balance faster. Compare offers and apply for the card that's right for you. An interest-free balance transfer card works best if you can pay off the balance in full by the end of the 0% period, because after this the rate is likely to. Each transfer must be a minimum of £ and you can transfer more than one balance. · You cannot transfer balances from store cards, any other card provided by. My halifax clarity card allows balance transfers with % Apr for 2 years. No fees for transfer. 14k limit my card, so pretty handy. Barclaycard Platinum up to 12 month balance transfer card (no transfer fee applies) · 0% interest on balance transfers for up to 12 months, which starts on the. Barclaycard Platinum up to 28 month balance transfer card. 0% interest on balance transfers for up to 28 months. From the date you open your account. Transfers. For example, as HSBC, First Direct, M&S Bank and John Lewis are all part of the HSBC Banking Group, you would not be able to transfer balances between these. Save money by transferring higher rate credit card balances. Credit Card. Our balance transfer credit card. Credit Card. Up to £8, credit limit. Maximum 3. A 0% balance transfer credit card offers an introductory interest rate of 0% for a set period of time. You can transfer a balance from an. Explore Chase balance transfer credit cards to save money and pay off your balance faster. Compare offers and apply for the card that's right for you. An interest-free balance transfer card works best if you can pay off the balance in full by the end of the 0% period, because after this the rate is likely to. Each transfer must be a minimum of £ and you can transfer more than one balance. · You cannot transfer balances from store cards, any other card provided by. My halifax clarity card allows balance transfers with % Apr for 2 years. No fees for transfer. 14k limit my card, so pretty handy. Barclaycard Platinum up to 12 month balance transfer card (no transfer fee applies) · 0% interest on balance transfers for up to 12 months, which starts on the.

A balance transfer is a method of debt consolidation where you combine existing credit card debt and other qualifying debts within one single credit card. This. Our Longer Balance Transfer Card offers 0% interest on balance transfers for 23 months, with a % balance transfer fee. You'll also benefit from 0% on. A balance transfer is when you move a balance you have on one credit or store card to another credit card, like your Barclaycard. It's an easy way to keep your. Balance transfers will not earn Capital One rewards · Continue to make your credit card and loan payments until you confirm that the transferred payment has been. The best business cards for balance transfers include the PNC Visa Business Card, as well as options from regional banks. You cannot transfer a balance from one Co-operative Bank or smile credit card to another. The amount you pay back each month will be up to you – though there. You can find balance transfer credit cards with interest rates as low as 0% for a set period of time as part of an introductory or promotional offer but once. Get a Balance Transfer credit card and enjoy 0% interest for 24 months on balance transfers. No annual fee. Subject to status. T&Cs apply. A balance transfer is when you transfer some - or all - of your credit card debt to another credit card, usually to save money on interest repayments. Why do. Credit Card Balance Transfer form (PDF). UKFCU provides easy access to your Payments can be made by mobile app, through online banking, or send. To avoid paying interest on your debt, you open a balance transfer credit card, which comes with 20 months at 0% and a one-off fee of 3% of the amount. With a money transfer, you can move money from your credit card to your UK-based current account. Want to know more? To help you understand the benefits. A balance transfer credit card lets you move your existing credit card balances to a new card with a lower or 0% interest rate. Balance transfer credit cards normally come with an initial 0% interest period – for instance, paying 0% interest for the first four months of you owning the. A balance transfer card may offer perks—like 0% introductory APR or no annual fee—that could help you save big. Some cards even let you earn rewards in the form. A balance transfer credit card could be a good option if you are paying interest on existing credit cards or stolen cards. Bringing balances from other credit. A balance transfer is when you move the balance from one credit or store card to another credit card with a different provider, usually to take advantage of. A balance transfer is when you move your existing credit card balance(s) to another credit card with a different provider. My halifax clarity card allows balance transfers with % Apr for 2 years. No fees for transfer. 14k limit my card, so pretty handy. A modern lifestyle credit card packed with rewards, no foreign exchange fees, and loads more. Apply without needing a UK credit score.

When Is A 1099 Needed

For K forms, the IRS requires filing if, in a calendar year, the gross amount of total reportable payments exceeds $5, and there are more than 0. Form is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various. Form MISC is used by payers in business to report specified miscellaneous payments other than nonemployee compensation (that are mostly $ or more). Form. Put another way, the rule that payments to lawyers must be the subject of a Form trumps the rule that payments to corporation need not be. Thus, any. If you're running a platform or marketplace, you may be required to file tax forms with the IRS and state authorities. A tax form is used to report. The Form is part of a series of IRS tax forms used to report income received throughout the year from sources other than wages and compensation reported on. However, if the foreign worker performs any work inside the United States, you would need to file the For that purpose, you should have that foreign. The NEC is the form that will be needed to report independent contractor payments for calendar year Business payers must issue s on Form MISC to recipients by January 31, , or February 15, , if amounts are reported in boxes 8 or Payers. For K forms, the IRS requires filing if, in a calendar year, the gross amount of total reportable payments exceeds $5, and there are more than 0. Form is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various. Form MISC is used by payers in business to report specified miscellaneous payments other than nonemployee compensation (that are mostly $ or more). Form. Put another way, the rule that payments to lawyers must be the subject of a Form trumps the rule that payments to corporation need not be. Thus, any. If you're running a platform or marketplace, you may be required to file tax forms with the IRS and state authorities. A tax form is used to report. The Form is part of a series of IRS tax forms used to report income received throughout the year from sources other than wages and compensation reported on. However, if the foreign worker performs any work inside the United States, you would need to file the For that purpose, you should have that foreign. The NEC is the form that will be needed to report independent contractor payments for calendar year Business payers must issue s on Form MISC to recipients by January 31, , or February 15, , if amounts are reported in boxes 8 or Payers.

The deadlines for NEC are February 28 (Paper Filing) & March 31 (E-Filing). copies are due to recipients by January 31, If you're running a platform or marketplace, you may be required to file tax forms with the IRS and state authorities. A tax form is used to report. Track offers a state e-filing service to certain states. For those states we don't yet support, we will give you the file to upload. Please see our. Form is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various. Persons engaged in a trade or business must file Form MISC when certain payments are made. A person is engaged in business if he or she operates for profit. The independent contractors that provided you services during the year most likely need a form of their own by the end of January as well—a MISC. What is a. Employers are required to distribute Form NECs to their independent contractors each year by the end of January. There are several ways employers can. Form K is used by third-party settlement organizations (“TPSOs”) to report the payment transactions they process for retailers or other third parties. If. Businesses are required to submit W-2s/s to Connecticut Dept. of Revenue by January Uploading W2s/s on myconneCT is the department's preferred. All individuals, businesses and corporations who are required to make a federal information report must file with the Missouri Department of Revenue an. The basic rule is that you must file a NEC whenever you pay an unincorporated independent contractor—that is, an independent contractor who is a sole. IEEE's year end reporting requirements. Payments made to US individuals for the following reasons are subject to MISC filing requirements: If. While the IRS does not require the Department to issue Form INT to taxpayers receiving refund interest of less than $, all interest received on refunds. There are several situations that require a Form or other information return to be filed. If you're not sure whether or not you need to file a form. Form K is used by third-party settlement organizations (“TPSOs”) to report the payment transactions they process for retailers or other third parties. If. A Form MISC is used to report payments made in the course of a trade or business to another person or business who is not an employee. The form is required. ADOR only requires submission of Form that report Arizona income tax withheld. Taxpayers only need to submit Form NEC if there is Arizona withheld. Track offers a state e-filing service to certain states. For those states we don't yet support, we will give you the file to upload. Please see our. These forms are used to report payments for rent, services, contractors, and other miscellaneous income payments. Features of the application include: MISC. Where amounts paid in settlement in a calendar year to a payee meet the Massachusetts threshold but not the IRS threshold, a TPSO should submit Form K to.

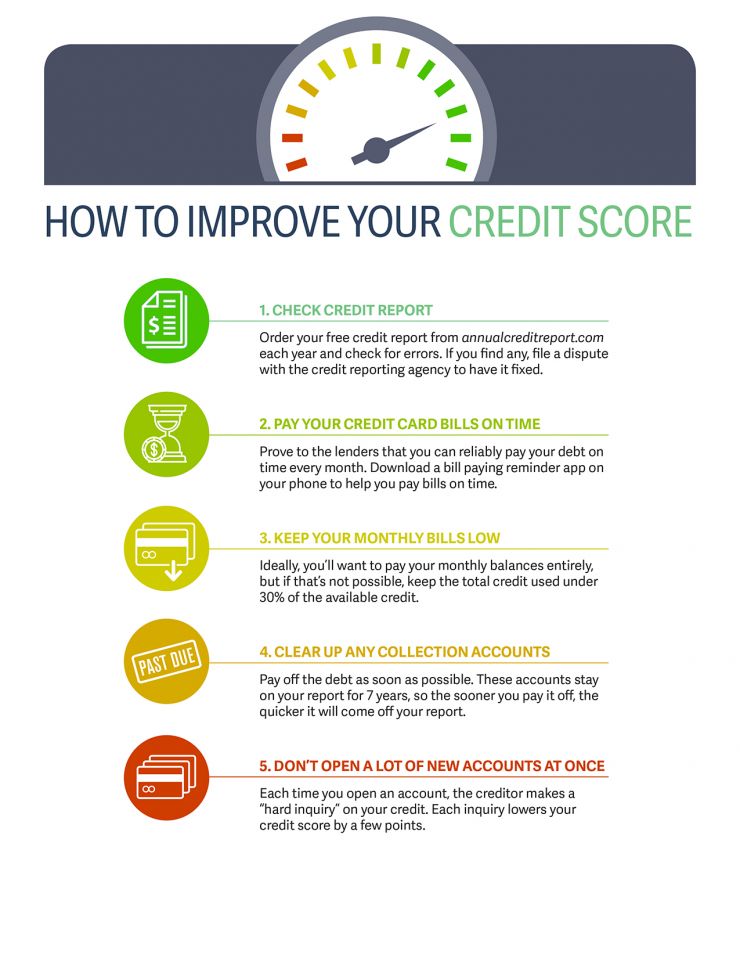

How To Improve Credit Score After Hard Inquiry

Making payments on time, keeping credit utilization low and avoiding unnecessary credit inquiries can help you improve your credit scores. Focusing on good. Your credit report is a lengthy record of your dealings with credit of all sorts, and it's used to create your score. Three credit bureaus — Equifax, Experian. 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit Your Requests for New Credit—and the Hard. Maintaining a mix of different types of credit can give your score a boost. A diverse mix may look like managing a car loan, credit card and mortgage all at. The best way to dispute Experian hard inquiries is by working with a skilled and experienced lawyer, like one from our team at Consumer Attorneys. Our lawyers. Step 1: Check Your Credit Report · Step 2: Make Arrangements to Bring Your Accounts Up To Date and Pay Down Debts · Step 3: Rebuild Credit with a Secured Credit. 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. First thing, a hard inquiry being removed from your credit report has ZERO impact on a credit score. Hard inquiries are removed after 2 years. Your score is most affected for 6 months. Between 6 and 12 months the impact decreases to zero. At 24 months the inquiry disappears from your report. Making payments on time, keeping credit utilization low and avoiding unnecessary credit inquiries can help you improve your credit scores. Focusing on good. Your credit report is a lengthy record of your dealings with credit of all sorts, and it's used to create your score. Three credit bureaus — Equifax, Experian. 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit Your Requests for New Credit—and the Hard. Maintaining a mix of different types of credit can give your score a boost. A diverse mix may look like managing a car loan, credit card and mortgage all at. The best way to dispute Experian hard inquiries is by working with a skilled and experienced lawyer, like one from our team at Consumer Attorneys. Our lawyers. Step 1: Check Your Credit Report · Step 2: Make Arrangements to Bring Your Accounts Up To Date and Pay Down Debts · Step 3: Rebuild Credit with a Secured Credit. 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. First thing, a hard inquiry being removed from your credit report has ZERO impact on a credit score. Hard inquiries are removed after 2 years. Your score is most affected for 6 months. Between 6 and 12 months the impact decreases to zero. At 24 months the inquiry disappears from your report.

If you're focused on increasing your score, consider limiting or pausing new applications for credit. A hard inquiry happens when a lender checks your credit to. Your official request for an inquiry removal along with reasons why you believe authorities should remove the inquiry; Any relevant supporting documents that. Your credit report is a lengthy record of your dealings with credit of all sorts, and it's used to create your score. Three credit bureaus — Equifax, Experian. While it's not as big a factor as missed payments or your credit-to-debt ratio, too many hard inquiries will negatively impact your credit score. Hard inquiries. Hard inquiries such as actively applying for a new credit card or mortgage will affect your score. Read below to see how much hard inquiries can affect your. To help improve your credit, make sure to pay your bills on time and try to only use a portion of the total credit available to you. Following a budget, keeping. The longer your credit card accounts are open (and in good standing), the better it is for your score. This includes accounts you no longer use and those with a. It is possible to get credit after the debt is paid off, even if the program is still reporting on the credit report, but creditors may place additional. However, each time you apply for credit, it results in a hard inquiry on your credit report. To prevent unnecessary inquiries, limit your rate shopping to a. What actions you can take to boost your credit scores? · Review your credit reports for errors and dispute any inaccuracies. · Keep paying your bills on time. You could add to your credit score with tips like paying cards more than once a month and fixing credit report errors. Updated Aug 27, · 5 min read. To help improve your credit, make sure to pay your bills on time and try to only use a portion of the total credit available to you. Following a budget, keeping. Applying for credit cards, bank loans or a new mobile phone account will all produce hard inquiries. A lot of hard credit inquiries indicate that you may be. All hard inquiries on your report may affect your credit score. Applying for the removal of credit inquiries only works if the inquiries came as a result of. How to minimize the number of hard inquiries you have · Don't apply for several credit cards within a short timeframe. · Only apply for credit cards you would. Aim to have as few hard inquiries on your credit report as possible. Applying for a new credit card or loan requires a hard inquiry, which can temporarily hurt. The most straightforward way to improve your credit history is by making payments on time. However, remember that minimum payments on installment loans work. To minimize the impact of opening up a new card account, try lowering your current debt first, to help bolster your credit score ahead of your application. How. Aim to have as few hard inquiries on your credit report as possible. Applying for a new credit card or loan requires a hard inquiry, which can temporarily hurt.

Can You Identify Someone By License Plate

A vehicle license plate search is similar to a VIN check. You type in the license plate number of a given vehicle, and we provide you with information about it. By Mail or In Person. If purchasing a plate by mail or at a customer service center, you will need to complete a License Plate Application. Is it legal to look up someone's license plate? It is perfectly legal to look up any license plate, as it is a matter of public records. But if you are trying. If you need a vehicle's license plate number but only have the VIN, you can find the license plate number by doing a VIN check. You can do this online or at the. It is illegal to run a license plate check on someone else, regardless of the circumstances. Only a member of law enforcement can run a license. How can we access vehicle information based solely on the number of the license plate? When vehicles are registered in New Jersey, that information becomes a. The best way to find a vehicle's registered owner using a license plate number is by contacting law enforcement or your insurance company. If you were the. By looking up the license plate record either with the DMV or through online license lookup services, you can find the person associated with the record. You can usually discover a person's car's make, model, and year by reviewing the license plate data. Some internet databases promise more detailed information. A vehicle license plate search is similar to a VIN check. You type in the license plate number of a given vehicle, and we provide you with information about it. By Mail or In Person. If purchasing a plate by mail or at a customer service center, you will need to complete a License Plate Application. Is it legal to look up someone's license plate? It is perfectly legal to look up any license plate, as it is a matter of public records. But if you are trying. If you need a vehicle's license plate number but only have the VIN, you can find the license plate number by doing a VIN check. You can do this online or at the. It is illegal to run a license plate check on someone else, regardless of the circumstances. Only a member of law enforcement can run a license. How can we access vehicle information based solely on the number of the license plate? When vehicles are registered in New Jersey, that information becomes a. The best way to find a vehicle's registered owner using a license plate number is by contacting law enforcement or your insurance company. If you were the. By looking up the license plate record either with the DMV or through online license lookup services, you can find the person associated with the record. You can usually discover a person's car's make, model, and year by reviewing the license plate data. Some internet databases promise more detailed information.

Registration (Plate) Record Searches To find a specific registration record, Dial-In needs either: You will perform your search in the REGISTRATION section. By using our license plate lookup tool you can find owner info, vehicle records, lien records and driving records. Our free search tool takes only seconds. In order to verify a registration, you have to first identify the plate and plate class. can be found on your current registration or the renewal notice you. You cannot. People don't have access to look up the tag numbers of others. Law Enforcement Agencies have access to such information, but they. Government officials, including the police, can find the vehicle owner's name via the license plate number. However, other people cannot. Is it legal to look up someone's license plate? It is perfectly legal to look up any license plate, as it is a matter of public records. But if you are trying. Once you know which car belongs to that individual, you can then run a license plate lookup by plate number to find other sightings of that vehicle and. You can search with a vehicle identification number (VIN), or you can search with a valid license plate number and state. if you can't find the VIN, it's. You can search by: Vehicle Identification Number (VIN); License plate number; Boat Hull Identification Number (HIN); Boat registration number (starting with WN). Where can I find License Plate information? License Plate information can be found at the Tennessee Department of Revenue. Wondering how to look up a license plate number? LookupAPlate allows you to search a license plate for free and view vehicle history. Additionally, you can. Did you know that it is possible to find the owner of a vehicle using a license plate lookup service? These sites benefit those who want to know who owns a. You could, however, contact the police to have them locate someone about an abandoned vehicle, for example. What Are Some Legal Uses of License Plate. Can Civilians Lookup License Plates in Texas? Yes. The State of Texas does not prohibit civilians from looking up license plate numbers to find vehicle-. You cannot use a license plate lookup to find the owner in Ohio unless you have a valid reason for doing so. For example, if you are a tow truck driver and. Short answer: NO, it is not illegal. Long answer: Even though some websites claim it is illegal, we've got some bad news: It is actually legal to find a vehicle. A license plate number identifies a vehicle. While it doesn't tell you who drove the car, it will tell you who owns it. If you can see the license plate number. Utah has three standard-issue plates and a variety of special plates, and most can be personalized recognize specific groups of people. Special group. The name and address of the current owner, vehicle identification number (VIN), title, and the license plate number will appear on the record. Also, the vehicle. Yes, as long as you have a valid reason according to the California and Federal laws regarding this search. You can typically run this type of search through.

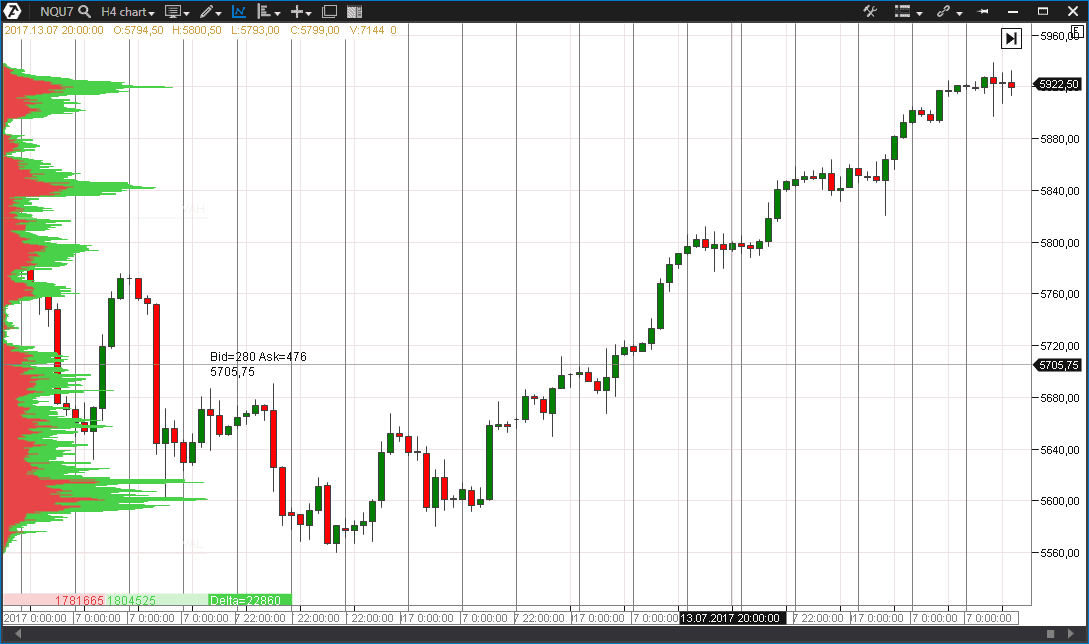

Stock Nasdaq Futures

The current price of NASDAQ E-mini Futures is 19, USD — it has fallen −% in the past 24 hours. Watch NASDAQ E-mini Futures price in more. Since there are futures on the indexes (S&P , Dow 30, NASDAQ , Russell ) that trade virtually 24 hours a day, we can watch the index futures to get a. KEY STATS · Open19, · Day High19, · Day Low19, · Prev Close19, · 10 Day Average Volume, · Open Interest · Exp Date trading higher. PositiveN,+%Positive. Get real-time market data from LSEG. NASDAQ Future. NQc1. Official Data Partner. Latest Trade. trading. Futures are contracts in which you're betting about whether a commodity will rise or fall in price by a certain date. NASDAQ futures are financial futures which launched on June 21, It is the financial contract futures that allow an investor to hedge with or speculate. Where the stock market will trade today based on Dow Jones Industrial Average, S&P and Nasdaq futures and implied open premarket values. stock index - settled on the price of the NASDAQ Stock index definition How to trade index futures Indices trading definition. Find the latest Nasdaq Sep 24 (NQ=F) stock quote, history, news and other vital information to help you with your stock trading and investing. The current price of NASDAQ E-mini Futures is 19, USD — it has fallen −% in the past 24 hours. Watch NASDAQ E-mini Futures price in more. Since there are futures on the indexes (S&P , Dow 30, NASDAQ , Russell ) that trade virtually 24 hours a day, we can watch the index futures to get a. KEY STATS · Open19, · Day High19, · Day Low19, · Prev Close19, · 10 Day Average Volume, · Open Interest · Exp Date trading higher. PositiveN,+%Positive. Get real-time market data from LSEG. NASDAQ Future. NQc1. Official Data Partner. Latest Trade. trading. Futures are contracts in which you're betting about whether a commodity will rise or fall in price by a certain date. NASDAQ futures are financial futures which launched on June 21, It is the financial contract futures that allow an investor to hedge with or speculate. Where the stock market will trade today based on Dow Jones Industrial Average, S&P and Nasdaq futures and implied open premarket values. stock index - settled on the price of the NASDAQ Stock index definition How to trade index futures Indices trading definition. Find the latest Nasdaq Sep 24 (NQ=F) stock quote, history, news and other vital information to help you with your stock trading and investing.

E-mini Nasdaq Options on Futures. With quarterly, serial, monthly, and weekly options listed on E-mini Nasdaq Index futures, CME Group provides you with. Get the latest Lumber price (LBR) as well as the latest futures prices and other commodity market news at Nasdaq. Nasdaq owns and operates seven European stock exchanges in Stockholm, Denmark, Finland, Iceland, Estonia, Latvia and Lithuania, providing financial services and. Futures are a type of derivative contract agreement to buy or sell a specific commodity asset or security at a set future date for a set price. Live Nasdaq futures prices and pre-market data on the E-mini Nasdaq Futures Index including charts, news, analysis and more Nasdaq Futures coverage. A stock futures contract is a commitment to buy or sell the financial exposure equivalent to a specific amount (contract multiplier) of shares of the. NASDAQ E-mini Futures contracts ; NQZ · D · , 19,, +%, ; NQH · D · , 19,, −%, − Nasdaq Futures is a stock market index futures contract traded on the Chicago Mercantile Exchange`s Globex electronic trading platform. The CFTC today issued an order filing and settling charges against Nasdaq Futures, Inc., formerly a View All Latest News. A high-level overview of NASDAQ Futures (USIND) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and. Get the latest Nasdaq EMini price (NQ:US) as well as the latest futures prices and other commodity market news at Nasdaq. E-mini Nasdaq futures can serve as a cost-efficient proxy for trading Facebook, Amazon, Netflix and Alphabet (Google), collectively known as the FANG stocks. Get the latest data from stocks futures of major world indexes. Find updated quotes on top stock market index futures. Today's market ; NYSE COMPOSITE (DJ), 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41, Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. US Futures Market Quotes (minute Delayed) ; S&P |ESU 5, ; Nasdaq |NQU 19, ; Russell Futures contracts have a minimum price fluctuation, also known as a tick. Tick sizes are among the contract specifications, a.k.a "specs," set by futures. Since there are futures on the indexes (S&P , Dow 30, NASDAQ , Russell ) that trade virtually 24 hours a day, we can watch the index futures to get a. US STOCK MARKETS FUTURES ; DOW JONES Futures. 41, ; NASDAQ Futures. 19, ; S&P Futures. 5, At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage.

Inherited Iras And Taxes

The IRS requires that most owners of IRAs withdraw part of their tax-deferred savings each year, starting at age 73 or after inheriting any IRA account. The taxable amount is reported on Form , Page 1 and is not reported on Form Attach a separate Form to the return to report the basis of the. If the entire balance is withdrawn in the first year, the beneficiary would pay $, in income tax, in effect making the inheritance worth only $, Those who inherit an IRA and who take distributions from it are taxed on the withdrawn income at their ordinary tax rate, regardless of whether the estate was. What are the tax features? Qualified distributions from an inherited Roth IRA are not taxed. However, distributions from other types of inherited IRAs are. Nonpersons (such as an estate or charity) that inherit IRAs generally must You generally must pay tax on inherited IRA assets. But depending on the. However, distributions from an inherited traditional IRA are taxable. This is referred to as “income in respect of a decedent.” That means if the owner would. Withdrawals from an inherited traditional IRA are taxed as ordinary income. Typically, Roth IRA distributions aren't taxable, except in cases when the original. An inherited IRA is an account that must be opened by the beneficiary of a deceased person's IRA. The tax rules are quite complicated. The IRS requires that most owners of IRAs withdraw part of their tax-deferred savings each year, starting at age 73 or after inheriting any IRA account. The taxable amount is reported on Form , Page 1 and is not reported on Form Attach a separate Form to the return to report the basis of the. If the entire balance is withdrawn in the first year, the beneficiary would pay $, in income tax, in effect making the inheritance worth only $, Those who inherit an IRA and who take distributions from it are taxed on the withdrawn income at their ordinary tax rate, regardless of whether the estate was. What are the tax features? Qualified distributions from an inherited Roth IRA are not taxed. However, distributions from other types of inherited IRAs are. Nonpersons (such as an estate or charity) that inherit IRAs generally must You generally must pay tax on inherited IRA assets. But depending on the. However, distributions from an inherited traditional IRA are taxable. This is referred to as “income in respect of a decedent.” That means if the owner would. Withdrawals from an inherited traditional IRA are taxed as ordinary income. Typically, Roth IRA distributions aren't taxable, except in cases when the original. An inherited IRA is an account that must be opened by the beneficiary of a deceased person's IRA. The tax rules are quite complicated.

If you inherited an individual retirement account (IRA), you may have to include part of the inherited amount in your income. See "What If You Inherit an IRA?". An inherited IRA is an individual retirement account (IRA) you open when you're the beneficiary of a deceased person's retirement plan. Most types of IRAs or. Suggested Searches: SALES TAX EXEMPT MANUFACTURING, when does a ticket expire, tax lien payoffs, overpaid use tax, transfer business, sales tax on drop. You will need to file a paper return. As the Modernized e-File (MeF) program of the IRS will only allow one copy of Form Nondeductible IRAs per taxpayer. What if You Inherit an IRA? Inherited from spouse. Treating it as your own. Inherited from someone other than spouse. IRA with basis. Federal estate tax. If the money has been in the Roth IRA for more than five years, the beneficiaries will not be required to pay any taxes on these distributions. It's important. Although the RMD for inherited Roth IRAs is similar to the RMD rules for inherited traditional IRAs, Roth IRA withdrawals are generally tax free as long as the. There is no 10% early withdrawal penalty (regardless of your age or the deceased owner), but you are taxed on the amount distributed if it is a Traditional IRA. If a beneficiary distributes the entire balance of the inherited IRA when they take possession of the assets, they may be pushed into a higher tax bracket for. For a newly retired couple with little other income coming in, a $,a-year distribution from an inherited IRA would be taxed at only the 12% marginal rate. Is a decedent's IRA or K subject to PA inheritance tax if the individual dies before age 59 1/2? Traditional IRAs are not subject to inheritance tax when the. How inherited IRAs and RMDs are taxed. If you inherit a traditional IRA, you're responsible for paying taxes on any RMDs at your regular income rate. If you don. But a rollover to your own IRA is not allowed if you inherit the IRA from anyone else. Before we dive in, there is an important thing to keep in mind: "Tax. Most non-spouse beneficiaries must withdraw all assets from the inherited IRA within 10 years, according to the SECURE Act. For inherited Roth IRAs, the inherited assets generally have no immediate income tax impact and the withdrawals are tax-free as long as the original owner met. If the executor moves the IRA directly into inherited IRAs for each of the beneficiary children, the beneficiaries would be responsible for paying the taxes. If. To start, distributions from Inherited Roth IRAs are typically tax-free as long as the original Roth IRA had been held for 5 years, while. Generally speaking, only the distributions from an inherited traditional IRA are taxable, just as they are for non-inherited traditional IRAs. If you inherit a Roth IRA, you don't pay taxes on distributions, but if you inherit a traditional IRA, you'll generally pay taxes on the distributions you take.

Finding Stocks To Day Trade

Scan the market, read trading news and find stocks that have the potential to make a big price move in just a few hours. Look for stocks that are experiencing trading volume greater than their day average volume. While pre-market gappers have high volatility, the combination of. Using a stock screener or scanner to filter stocks based on certain criteria, such as price, volume, volatility, sector, industry, earnings. Work with top-quality day trading experts who will get your project done just right. s sumeet_7. Sumeet Singh. (3). Online Trading Lessons. Day trading. Day traders can choose stocks that tend to move a lot, either in dollar terms or percentage terms. These two filters will often produce different results. How To Day Trade Stocks For Profit is a complete course designed to get you quickly making money from the stock market. No previous trading experience is. Best Stocks to Day Trade · Nvidia Corp. (NVDA) · ProShares UltraPro Short (SQQQ) · Tesla Inc. (TSLA) · Marathon Digital Holdings (MARA) · GameStop Corp. (GME). In this course, you'll learn how to read day trading charts, premarket preparation, gauge buy and sell zones, scan for penny stocks to trade, and prepare for. In this article, we explore some of the characteristics to keep an eye out for when trying to identify the best stocks for day trading this year. Scan the market, read trading news and find stocks that have the potential to make a big price move in just a few hours. Look for stocks that are experiencing trading volume greater than their day average volume. While pre-market gappers have high volatility, the combination of. Using a stock screener or scanner to filter stocks based on certain criteria, such as price, volume, volatility, sector, industry, earnings. Work with top-quality day trading experts who will get your project done just right. s sumeet_7. Sumeet Singh. (3). Online Trading Lessons. Day trading. Day traders can choose stocks that tend to move a lot, either in dollar terms or percentage terms. These two filters will often produce different results. How To Day Trade Stocks For Profit is a complete course designed to get you quickly making money from the stock market. No previous trading experience is. Best Stocks to Day Trade · Nvidia Corp. (NVDA) · ProShares UltraPro Short (SQQQ) · Tesla Inc. (TSLA) · Marathon Digital Holdings (MARA) · GameStop Corp. (GME). In this course, you'll learn how to read day trading charts, premarket preparation, gauge buy and sell zones, scan for penny stocks to trade, and prepare for. In this article, we explore some of the characteristics to keep an eye out for when trying to identify the best stocks for day trading this year.

End-of-day trading tends to solidify the consensus established by action earlier in the day. Stocks that have been trending up typically keep rising, while. Each trading session, IBD Stock Of The Day will help you both build your list of stocks to watch and improve your stock-picking skills. Every day, you'll. How To Day Trade Stocks For Profit is a complete course designed to get you quickly making money from the stock market. No previous trading experience is. Day trading means taking advantage of same-day price fluctuations in stocks, futures, or forex. Learn more about becoming a day trader, reading charts and. Here's how to find day trading stocks that could be provide potential for profits, and the characteristics to look for. You shouldn't be focused on finding a stock, you should find a strategy and what you trade will depend on that strategy. Market movers inside TradingSim will allow you to pick a random day 6 months in the past and actually see what the most active stocks were for that day. Just as. Selecting the right stock will determine the amount of profit you make. If you trade stocks of high volatility and liquidity, you will easily get buyers and. Both approaches are fundamentally valid; however, make sure that for day trading only select stocks that perform well in three aspects: Volatility, trading. In order to make profitable trades you will need to find stocks with higher volatility, have sufficient volume and have a low enough price to be able to invest. Finding stocks to day trade is easy with the Scanz Pro Scanner. Simply define your goal, choose your setups, and then build a scan to find setups in real-time. Do you actively trade stocks? If so, it's important to know what it means to be a "pattern day trader" (PDT) because there are requirements associated with. Overview: Top online brokers for day trading in September · Fidelity Investments · Interactive Brokers · TradeStation · E-trade Financial · Charles Schwab. The best online trading platforms for day trading offer advanced features, fast execution and free quality research. Fidelity, Interactive Brokers, Schwab. All day traders want to deal in stocks that offer the same characteristics: volume, volatility, liquidity and range – all of which are needed to make a great. The stock had gapped up or down in the pre-market and wasn't doing much during the day. I developed the “during the day scan”, discussed below, to find stocks. To participate more actively in the market, it's important to know what kind of trader you want to be and which metrics to follow. Schwab's veteran traders. Day trading is the opposite of a long-term investment strategy, in which an individual holds stocks or securities in hopes that they appreciate in value over. 8 rules for selecting stocks for intraday trading · 1. Choose liquid stocks · 2. Avoid volatile stocks · 3. Invest in correlated stocks · 4. Follow market trends · 5. 17 Best Day Trading Stocks · Zoom Is A Day Trader's Dream · DocuSign Is The Future Of Contracts · Tesla Share Price Volatility Creates Opportunities · Teladoc Is.

Hr And Payroll For Small Business

The best payroll software for small business includes Gusto, RUN Powered by ADP, QuickBooks Payroll, OnPay, Patriot Payroll, Roll by ADP and Payroll4Free. Payroll processing can be a time-consuming activity. Many companies now specialize in delivering payroll software for small businesses to simplify and automate. Best for comprehensive features: OnPay · Best for user experience: Gusto · Best for affordability: Wave Payroll · Best for payroll and bookkeeping: Intuit. View video about online payroll and HR services from Paycor. Easily run payroll on any computer with streamlined, cloud-based software. PCMag has been reviewing payroll software for small businesses for almost 20 years. The best payroll services do all the complicated math for you and send out. The best payroll option for any business is a robust, customizable payroll software that ensures accuracy, compliance, and efficiency. Chetu, a. Our simple software helps you run payroll, file taxes, handle compliance, and basically takes care of all of the nitty gritty so you don't have to. As your business grows, so does your list of responsibilities. When you outsource payroll and other HR services with G&A Partners, our trusted experts will. Best for Small Businesses: Justworks · Most User-Friendly: Gusto · Best for Growing Businesses: ADP Run · Best for Global Payroll: Rippling · Best for QuickBooks. The best payroll software for small business includes Gusto, RUN Powered by ADP, QuickBooks Payroll, OnPay, Patriot Payroll, Roll by ADP and Payroll4Free. Payroll processing can be a time-consuming activity. Many companies now specialize in delivering payroll software for small businesses to simplify and automate. Best for comprehensive features: OnPay · Best for user experience: Gusto · Best for affordability: Wave Payroll · Best for payroll and bookkeeping: Intuit. View video about online payroll and HR services from Paycor. Easily run payroll on any computer with streamlined, cloud-based software. PCMag has been reviewing payroll software for small businesses for almost 20 years. The best payroll services do all the complicated math for you and send out. The best payroll option for any business is a robust, customizable payroll software that ensures accuracy, compliance, and efficiency. Chetu, a. Our simple software helps you run payroll, file taxes, handle compliance, and basically takes care of all of the nitty gritty so you don't have to. As your business grows, so does your list of responsibilities. When you outsource payroll and other HR services with G&A Partners, our trusted experts will. Best for Small Businesses: Justworks · Most User-Friendly: Gusto · Best for Growing Businesses: ADP Run · Best for Global Payroll: Rippling · Best for QuickBooks.

Paychex has HR and Payroll solutions to fit the needs of any size business. Let Paychex help you take your business where it needs to go. Bambee is a cloud-based HR platform designed specifically for small and medium-sized businesses. In addition to HR functions, Bambee also offers a guided. Why use QuickBooks Online Payroll software? Small business owners can pay and manage their teams with integrated payroll, and access HR, health benefits, and. With a comprehensive payroll solution and extensive HR resources, small businesses can avoid manual data entry errors and stay current with the latest. Paylocity's HRIS for small business provides integrated HR & payroll solutions tailored specifically for growing businesses like yours. What are the Best Payroll Services for Small Businesses? ; 2. OnPay. OnPay · Comprehensive payroll features; User-friendly interface; Included HR tools ; 3. ADP. “Having all HR, payroll and benefits information in one place, accessible for reporting and analyzing has made a world of difference. Not only does Namely save. ADP's affordable, fast, and easy-to-use online payroll and HR software for small businesses is tailor-made to fit the needs of a smaller-scale business. Payroll services are more valuable when they integrate seamlessly with accounting software or HR tools. This allows for the easy sharing of information between. Remote's intuitive platform empowers small businesses with employees to run international payroll, file taxes, and maintain compliance no matter where. Hire, pay, and manage your team all in one place. Put the joy back in running your business. Work faster and reduce errors with automated payroll, HR, and more. Streamline payroll and access powerful tools for your small business with QuickBooks Payroll. Start your payroll services today with a free trial today. Give your smaller HR team the power to make a big difference. UKG Ready® is the all-in-one HR, payroll, talent, and time platform that provides the technology. Access HR software, payroll services, benefits, and support that can help you run your business more easily giving you time to focus on scaling your business. Paycom offers easy-to-use payroll software for small businesses that automates HR, taxes and payroll for both employers and employees. Our small business payroll software empowers your people to manage every aspect of their paycheck — including benefits, expenses, tax setup and PTO. Payroll software for small business automates payroll, taxes, and filings, saving you time, trouble and expense. SurePayroll innovated payroll operations Gusto is an all-in-one HR platform that offers tools for full-service payroll. Employee benefits, time and attendance, hiring and onboarding, and insights and. Many payroll software like Gusto, QuickBooks Payroll, and Zenefits are well-known and dependable payroll provider options for small businesses. For example, Gusto, our No. 1 Best Small Business Payroll Software, charges $40 monthly. You also pay an additional monthly fee for each person you pay. It.

Choosing A Car Insurance Company

Choosing and using your auto insurance coverage. Page 2. Washington State When you shop for auto insurance, remember that each company uses these. Every car is allocated to a particular insurance grouping. This is based on factors such as cost, how long it takes to repair, performance and safety and. 1. Determine the level of coverage you need · 2. Review the financial health of car insurers · 3. Compare several car insurance quotes · 4. Ask about discounts. Selective Choice Replacement Cost℠– pays to replace a vehicle with the latest model year available at the time of loss and gives you the choice of coverage for. This is the amount to be paid by the driver when settling an auto insurance claim. In most cases, the insurance company subtracts the deductible from the money. Comparing car insurance quotes online can help you narrow down carriers with auto insurance rates that fit your budget and coverage needs. We've made it easy to pick the best car insurance to meet your needs and budget in just 5 steps. brianladd.online the coverages you need. Does your vehicle have the right protection? Best practices for buying auto insurance · Research the types of coverage offered and what is required in your state. Always comparison shop, either through the broker you choose or the insurance companies you call directly. · Consider higher deductibles when getting a new quote. Choosing and using your auto insurance coverage. Page 2. Washington State When you shop for auto insurance, remember that each company uses these. Every car is allocated to a particular insurance grouping. This is based on factors such as cost, how long it takes to repair, performance and safety and. 1. Determine the level of coverage you need · 2. Review the financial health of car insurers · 3. Compare several car insurance quotes · 4. Ask about discounts. Selective Choice Replacement Cost℠– pays to replace a vehicle with the latest model year available at the time of loss and gives you the choice of coverage for. This is the amount to be paid by the driver when settling an auto insurance claim. In most cases, the insurance company subtracts the deductible from the money. Comparing car insurance quotes online can help you narrow down carriers with auto insurance rates that fit your budget and coverage needs. We've made it easy to pick the best car insurance to meet your needs and budget in just 5 steps. brianladd.online the coverages you need. Does your vehicle have the right protection? Best practices for buying auto insurance · Research the types of coverage offered and what is required in your state. Always comparison shop, either through the broker you choose or the insurance companies you call directly. · Consider higher deductibles when getting a new quote.

When you contact an agency about buying auto insurance, start by finding out how many and what companies they represent. You may be able to get cost quotes from. Traffic Accidents and Insurance · Uninsured/Underinsured Motorist Coverage · Collision Coverage · Bodily Injury Liability Coverage · Property Damage Liability. There's no one-size-fits-all approach when it comes to car insurance. Where you live, how you drive your vehicle, and the vehicle type can help determine the. Where you live can have a large impact on your coverage. Your province, city, and even your postal code are factored in when insurers determine costs. If you. Generally, it's a good idea to compare policies from at least three different insurers. You'll want to consider fundamental factors such as coverage and price. Your deductible is the amount that you're required to pay out of pocket before your insurance company will chip in in the event of a claim. By choosing a higher. Your first car insurance policy should strike a balance between affordability and the right amount of coverage. Choosing the cheapest car insurance policy may. The rating factors you have control over are the car you have, where you live, your driving record, and your credit. Each company will rate you. There are three ways to get car insurance: buying it online, contacting a company representative (sometimes called a captive agent), or working with an. However, remember that the deductible you choose is what you are responsible for paying out of your pocket in the event you file a claim against your automobile. Don't Shop By Price Alone. Price is only one of many factors to consider in selecting an insurance company. Keep a number of the following key considerations in. Choose an insurance company that has a solid financial standing, a reasonable claim payment ratio, is easily accessible, and processes claims. 9 questions to ask your car insurance company · 1. Are there any additional auto discounts I can get? · 2. Am I sufficiently covered? · 3. What isn't currently. Discuss your insurance needs openly with your agent, broker, or insurance company. They can help you, but it is your responsibility to choose the insurance that. There are many factors to look at when researching the best auto insurance companies. Some important things to look for include. Choosing the right coverage from the list above is the first step to buying car insurance. The next is requesting quotes for that coverage from multiple. The best way to get cheaper car insurance is to compare quotes from multiple companies and then switch to whichever insurer offers the coverage you want at the. You may choose from companies which have local or non local agents. The services of the local agent may be of importance when you buy the policy or when you. Shop for the company or agent that offers the best service for the best price. If you have a clean driving record, avoid companies and agents that advertise to. How do you compare car insurance quotes? Choose your coverage. Consider your state's requirements and any specific coverage types you might want, like.

How To Buy Foxconn Stock

The Foxconn Technology stock price is USD today. How to buy Foxconn Technology stock online? You can buy Foxconn Technology shares by opening an. Foxconn Industrial Internet Co., Ltd. Reports Earnings Results for the Half Year Ended June 30, Aug. 04 CI. Foxconn Industrial Internet to Buy Back Shares. Complete Foxconn Technology Co. Ltd. stock information by Barron's. View real-time stock price and news, along with industry-best analysis. Buy. Full Ratings. Overview. news. Barron's. Other Dow Jones. Press Releases. No data provided. People. Key Executives. Board Members. Zhan Wu Zhang. Chairman. Money flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an "uptick" in price and the value of trades made. On 25 February , Sharp accepted a ¥ billion (US$ billion) takeover bid from Foxconn to acquire over 66 percent of Sharp's voting stock. Get Foxconn Technology Co Ltd (TW:Taiwan Stock Exchange) real-time stock quotes, news, price and financial information from CNBC. Buy/Sell Ratios · Latest Insider Trades · CEO Purchases - Last 7 Days · Most NP, VSGX - Vanguard ESG International Stock ETF ETF Shares This fund is a. | Complete Foxconn Technology Co. Ltd. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. The Foxconn Technology stock price is USD today. How to buy Foxconn Technology stock online? You can buy Foxconn Technology shares by opening an. Foxconn Industrial Internet Co., Ltd. Reports Earnings Results for the Half Year Ended June 30, Aug. 04 CI. Foxconn Industrial Internet to Buy Back Shares. Complete Foxconn Technology Co. Ltd. stock information by Barron's. View real-time stock price and news, along with industry-best analysis. Buy. Full Ratings. Overview. news. Barron's. Other Dow Jones. Press Releases. No data provided. People. Key Executives. Board Members. Zhan Wu Zhang. Chairman. Money flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an "uptick" in price and the value of trades made. On 25 February , Sharp accepted a ¥ billion (US$ billion) takeover bid from Foxconn to acquire over 66 percent of Sharp's voting stock. Get Foxconn Technology Co Ltd (TW:Taiwan Stock Exchange) real-time stock quotes, news, price and financial information from CNBC. Buy/Sell Ratios · Latest Insider Trades · CEO Purchases - Last 7 Days · Most NP, VSGX - Vanguard ESG International Stock ETF ETF Shares This fund is a. | Complete Foxconn Technology Co. Ltd. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview.

We go over how you can buy Foxconn stock stateside. How do I buy Foxconn Technology Co shares? To buy shares in Foxconn Stock are classified on the the following spectrum: Super Stocks, High Flyers. What ETF is Foxconn Industrial Internet Co., Ltd. in? Information about cost, fund size and performance of the ETFs that contain this stock. Signed MoU on Green Power Purchase with Foxwell Power to Accelerate Net Zero Foxconn Interconnect Technology listed on the Hong Kong Stock Exchange. U.S. Foxconn is listed and trades on the Taiwan stock exchange. What Is the Stock Symbol for Foxconn? The stock symbol for Foxconn is " FOXCONN VENTURES PTE. LTD. Dated as of November 7, Table of Other than 7,, shares of Common Stock and warrants to acquire 1,, shares. Assess the Foxconn stock price estimates. View analyst opinion as to whether the stock is a strong buy, strong sell or hold, based on analyst Month Stocks. Taiwan. Assuming the 90 days trading horizon and your above-average risk tolerance, our recommendation regarding Foxconn Technology Co is 'Hold'. A. brianladd.online Executives. Liu Young-Way. (“Young”). Chairman/President/CEO. 7/ – Present. Dr Chen Wei-Ming. (“Bob”). General Manager:Business Group. 7/. I am unable to directly purchase shares of Foxconn as this company is not listed on US exchanges and I presently reside in the US. HNHPF is. Stock analysis for Foxconn Technology Co Ltd (FXCOF:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and company. How to buy FOXCONN TECH CO stocks? How to invest in Hon Hai (Foxconn) easily, quickly and securely · 1. Sign up to Bitpanda. Sign up to create your free Bitpanda account. · 2. Verify. Verify your. The latest Foxconn stock prices, stock quotes, news, and HNHAF history to help Foxconn Analyst Opinions. All. All; Buy; Hold; Sell. Date, Analyst, Rating. Check if HNHAF Stock has a Buy or Sell Evaluation. HNHAF Stock Price (PINK), Forecast, Predictions, Stock Analysis and Foxconn Technology Group News. Apple Supplier Foxconn's Stock Jumps. Forget the iPhone, Thank the AI Boom. Research Foxconn Technology's (TWSE) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and. Shares Out (Mil): 1, Market Cap: 97, Forward P/E: Dividend Yield: Key Statistics. mean rating - 2 analysts. Sell. Hold. Buy. P/E. Taiwan Stock Exchange. Corporate Integrity · FAQ Hon Hai Technology Group (Foxconn) Inaugurates Residential Housing Complex In Industrial Park In India. Foxconn. ALL · News · Opinion · Photos · Videos. Jump to. Select Tag, Narendra Modi » Stock List ·» MF List ·» Glossary ·» Sitemap ·» Live TV & Shows ·».