brianladd.online

Community

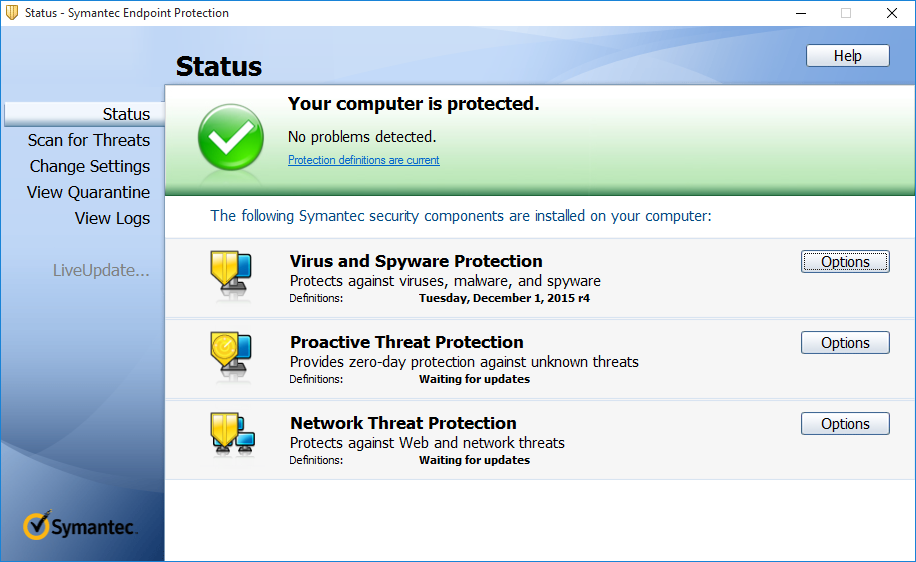

Symantec Malware

Symantec · Business Security Test (August - November). not approved · Malware Protection Test Enterprise September - Testresult Part of Business. Antivirus software is used on University Systems to help prevent and protect from viruses, spyware, and Malware. Symantec provides security products and solutions to protect small, medium, and enterprise businesses from advanced threats, malware, and other cyber. The IMail Anti-virus powered by Symantec™ server checks all incoming and outgoing mail for viruses, worms, trojan horses, and other malware. Live Update. Symantec Endpoint Protection Cloud · Anti-Virus - Protects against malware, rootkits, spyware and similar file-based malicious code and has the usual options of. In previous posts we explained that traditional Anti-malware software is not working anymore and we gave tips on how to improve your security with. The Symantec Malware Analysis (MA) appliance evaluates the threat of a given file in one or more Windows Virtual Machines or emulated Virtual Machines and. With Symantec Cloud security solutions and Softchoice, you can leverage endpoint protection, malware and threat responses, encryption and more. Compare similar Symantec Malware Analysis Cloud Offload - subscription license (1 Symantec Malware Analysis Cloud Offload - subscription license (1. Symantec · Business Security Test (August - November). not approved · Malware Protection Test Enterprise September - Testresult Part of Business. Antivirus software is used on University Systems to help prevent and protect from viruses, spyware, and Malware. Symantec provides security products and solutions to protect small, medium, and enterprise businesses from advanced threats, malware, and other cyber. The IMail Anti-virus powered by Symantec™ server checks all incoming and outgoing mail for viruses, worms, trojan horses, and other malware. Live Update. Symantec Endpoint Protection Cloud · Anti-Virus - Protects against malware, rootkits, spyware and similar file-based malicious code and has the usual options of. In previous posts we explained that traditional Anti-malware software is not working anymore and we gave tips on how to improve your security with. The Symantec Malware Analysis (MA) appliance evaluates the threat of a given file in one or more Windows Virtual Machines or emulated Virtual Machines and. With Symantec Cloud security solutions and Softchoice, you can leverage endpoint protection, malware and threat responses, encryption and more. Compare similar Symantec Malware Analysis Cloud Offload - subscription license (1 Symantec Malware Analysis Cloud Offload - subscription license (1.

Secure One Services, Symantec/Blue Coat Malware Analysis Appliance S Annual Content Subscription - 1YR Pricing, $20, Symantec Endpoint Protection will scan your hard drive every week to eliminate any viruses that may not have been caught by the Proactive Threat Protection. Symantec Insight™ and SONAR offer an intelligent and innovative security approach that can detect malware as soon as it appears. Powering Symantec Endpoint. Sites that pass the scan will display the Symantec Trust Seal. Frequent web site malware scanning could provide you as a site owner early warning of a problem. Symantec Content and Malware Analysis Content Analysis delivers multi-layer file inspection to protect your organization against known and unknown threats. Secure One Services, Symantec/Blue Coat Malware Analysis Appliance S Annual Content Subscription - 1YR Pricing, $20, Symantec Endpoint Protection is designed to protect against advanced malware threats with powerful, layered protection backed by industry leading security. With Symantec Email brianladd.online, users are protected from business email compromise, credential theft and malware with Email Threat Isolation and more. Symantec Endpoint Protection. A single-agent platform that that consists of Virus and Spyware Protection, Anti-malware, Intrusion Prevention and Firewall. This malware analyzer uses a unique multi-layer inspection and dual-sandboxing approach to reveal malicious behavior and expose zero-day threats. Symantec's Anti-Malware Software Features · Regular scans of files, folders, and system processes to detect and remove malware infections. A blog from the mobile security provider Lookout Mobile Security disputed Symantec's assessment the download apps are malware, although Lookout said it believes. SONAR is the abbreviation for Symantec Online Network for Advanced Response. Unlike virus signatures, SONAR examines the behavior of applications to decide. Symantec Malware Analysis Sandboxing Add-on - On-premise Subscription License Extension - 1 License - 1 Year. Strong security including real-time anti-malware scanning, real-time file integrity monitoring, application isolation, and OS hardening protect workloads. Unit 42 Technical Analysis: Seaduke. Earlier this week Symantec released a blog post detailing a new Trojan used by the 'Duke' family of malware. -borne threats such as: ❎ Phishing sites ❎ Malware downloads ❎ Malicious advertisements ❎ Compromised websites Learn more about active threats from Symantec's. Symantec Endpoint Protection - Ransomware · What is Ransomware? Ransomware is a category of malware that sabotages documents and makes then unusable, but the. Symantec features the best security against all kinds of threats. The solution saved our employees' time in responding to threats in the region of %. It.

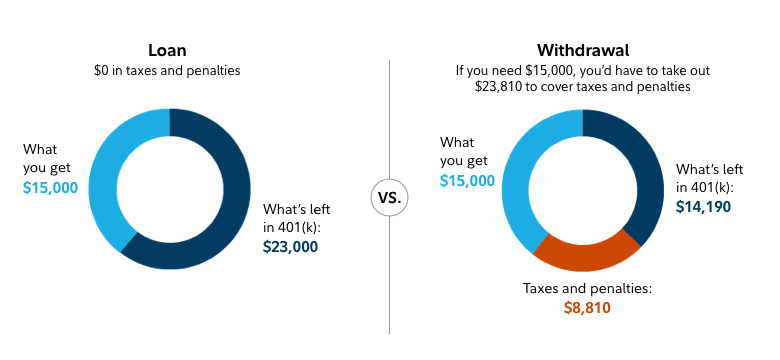

Home Loan 401k Rules

Employer-sponsored (k) plans may — but aren't required to — allow account holders to access savings through loans. Plans vary in their loan stipulations;. Taking a loan against your Merrill Small Business (k) account may seem to have This will decrease your take-home pay and may lead to the decision to. Generally, the employee must repay a plan loan within five years and must make payments at least quarterly. The law provides an exception to the 5-year. Short-term (k) loans · You may consider taking a loan on your (k) if you have a one-time demand that requires a lump-sum cash payment or an emergency that. If a participant has had no other plan loan in the 12 month period ending on the day before you apply for a loan, they are usually allowed to borrow up to 50%. Because the money needed for a down payment is not always easy to come by, lenders of all types allow borrowers to apply money from a K loan to their down. The maximum amount that the plan can permit as a loan is (1) the greater of $10, or 50% of your vested account balance, or (2) $50,, whichever is less. What are the loan repayment rules? You are required to repay your loan in LAST NAME. FIRST NAME. MI. HOME MAILING ADDRESS - NUMBER AND STREET ❑CHECK. The funds in your (k) retirement plan can be tapped for a down payment for a home. You can either withdraw or borrow money from your (k). Employer-sponsored (k) plans may — but aren't required to — allow account holders to access savings through loans. Plans vary in their loan stipulations;. Taking a loan against your Merrill Small Business (k) account may seem to have This will decrease your take-home pay and may lead to the decision to. Generally, the employee must repay a plan loan within five years and must make payments at least quarterly. The law provides an exception to the 5-year. Short-term (k) loans · You may consider taking a loan on your (k) if you have a one-time demand that requires a lump-sum cash payment or an emergency that. If a participant has had no other plan loan in the 12 month period ending on the day before you apply for a loan, they are usually allowed to borrow up to 50%. Because the money needed for a down payment is not always easy to come by, lenders of all types allow borrowers to apply money from a K loan to their down. The maximum amount that the plan can permit as a loan is (1) the greater of $10, or 50% of your vested account balance, or (2) $50,, whichever is less. What are the loan repayment rules? You are required to repay your loan in LAST NAME. FIRST NAME. MI. HOME MAILING ADDRESS - NUMBER AND STREET ❑CHECK. The funds in your (k) retirement plan can be tapped for a down payment for a home. You can either withdraw or borrow money from your (k).

Short-term (k) loans · You may consider taking a loan on your (k) if you have a one-time demand that requires a lump-sum cash payment or an emergency that. Taking a loan against your Merrill Small Business (k) account may seem to have This will decrease your take-home pay and may lead to the decision to. Texa$aver allows a maximum of two loans per Plan. Examples: If your balance is $1,–$10,, you may borrow the entire balance (as long as the $50 loan. Here's what to watch out for: You'll need to repay the loan in full or it can be treated as if you made a taxable withdrawal from your plan — so you'll have to. Also, a 10% early withdrawal penalty applies on withdrawals before age 59½, unless you meet one of the IRS exceptions. Fidelity Viewpoints. Sign up for Fidelity. Wont have a job, will need to repay the k loan, as well as any other mortgage/tax/loan payments owed. You really should save the cash for. How may taxation of Solo k participant loans be avoided? · The loan must be paid in full within five years, unless the loan is used to acquire a principal. First, it's possible for a first-time homebuyer to take a loan from an existing (k). Your employer generally sets the rules for (k) loans, but you. Interest Rates. A (k) loan interest rate is usually a point or two above the prime rate. The current prime rate is %, so. Taking a loan from your (k) does not trigger a taxable event and you are not hit with the 10% early withdrawal penalty for being under the age of (k). k loan has max of $50k or 50%, whichever is lower · k loan may need to paid back immediately, if you lose job to avoid tax penalty · k. Most (k) plans allow you to borrow up to 50% of your vested account balance, but no more than $50, (Vested funds refer to the portion of the funds that. 1. You're missing out on investment growth. When you reduce the balance of your (k) account, you have less money growing along with potential gains in the. (k) loan rules · Loan amounts: You can borrow 50% or up to $50, of your vested account balance. · Repayment: In most cases, you must repay the loan in. You can borrow money from your retirement plan and pay the funds back with lower interest rates than other types of borrowing, such as a credit card. Before borrowing, figure out if you can comfortably pay back the loan. The maximum term of a (k) loan is five years unless you're borrowing to buy a home, in. The second way to use your (k) funds to buy a house is to take out a loan from your plan. You do not have to pay the early withdrawal penalty or income tax. While most (k) loans require repayment within 5 years, for some first-time homebuyers, that period may be extended. What are the drawbacks to using a (k). The rules do not require a minimum loan amount, but plans are able to set one so that participants are not continually asking for loans for small amounts. As a. You can use your (k) for a down payment by withdrawing funds or taking out a loan. Each option has its own pros and cons — the best for you will depend.

How Do I Pay Down My Credit Card Debt

Create a credit card repayment plan · Stop adding to your debt · Follow the debt snowball method · Follow the debt avalanche method · Find ways to earn more. Paying off debt · Figure out how much you owe. Write down how much you owe to each creditor. · Focus on one debt at a time. Start with the credit cards or loans. 1. Understand how the debt happened · 2. Consider debt payoff strategies · 3. Pay more than the minimum · 4. Reduce spending · 5. Switch to cash · 6. Consolidate or. When you take out a debt consolidation loan, you use the proceeds to pay off all your credit card debt. Then, instead of making payments to several creditors. Target one debt at a time · Focus on high-interest debt · Try the snowball method ; Consolidate debt · Transfer balances · Tap into your home equity ; Review your. Pay as much as you can toward that debt each month until your balance is once again zero, while still paying the minimum on your other cards. The same advice. What to Do · List your credit cards from lowest balance to highest. · Pay only the minimum payment due on the cards with larger balances. · Pay additional on the. There are two methods when it comes to paying off your credit card debt: the avalanche method or the snowball method. With the avalanche method, you pay the. This means you could transfer your credit card debt and not have to deal with interest for several months or even a year (depending on the card). While our. Create a credit card repayment plan · Stop adding to your debt · Follow the debt snowball method · Follow the debt avalanche method · Find ways to earn more. Paying off debt · Figure out how much you owe. Write down how much you owe to each creditor. · Focus on one debt at a time. Start with the credit cards or loans. 1. Understand how the debt happened · 2. Consider debt payoff strategies · 3. Pay more than the minimum · 4. Reduce spending · 5. Switch to cash · 6. Consolidate or. When you take out a debt consolidation loan, you use the proceeds to pay off all your credit card debt. Then, instead of making payments to several creditors. Target one debt at a time · Focus on high-interest debt · Try the snowball method ; Consolidate debt · Transfer balances · Tap into your home equity ; Review your. Pay as much as you can toward that debt each month until your balance is once again zero, while still paying the minimum on your other cards. The same advice. What to Do · List your credit cards from lowest balance to highest. · Pay only the minimum payment due on the cards with larger balances. · Pay additional on the. There are two methods when it comes to paying off your credit card debt: the avalanche method or the snowball method. With the avalanche method, you pay the. This means you could transfer your credit card debt and not have to deal with interest for several months or even a year (depending on the card). While our.

Limit credit card use. · Use a card with no balance for normal purchases. · Open a Huntington Checking Account · Budget more for paying off debt. · Make extra. Step 1: Make all your minimum payments · Step 2: Build up a cash buffer · Step 3: Capture the full employer match · Step 4: Pay off any credit card debt · Step 5. Talk with your credit card company, even if you've been turned down before for a lower interest rate or other help with your debt. Instead of paying a company. Options for paying off your credit card balance include: · 1. Making a budget. Find out if you can make savings anywhere. This will: Free up money to increase. The best strategy for paying off credit card debt at the lowest cost is the “avalanche method.” Basically, you start by paying as much as. 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a time. · 4. Consolidate credit card debt. · 5. Follow the steps: Step 1: Continue to make the minimum payments on all your credit cards. Step 2: Use your extra money towards the credit card with the smallest. How do I pay off my credit card debt? · Start by understanding your finances, so you know what you can afford to pay each month. · Use this budget to set aside an. Talk with your credit card company, even if you've been turned down before for a lower interest rate or other help with your debt. Instead of paying a company. Related content. 4 strategies to pay off credit card debt faster. Read more, 2 That's why it's important to understand your options and choose a debt payoff. 1. List your credit cards from lowest balance to highest. 2. Pay only the minimum payment due on the cards with larger balances. 3. The debt snowball method involves making just the minimum payments on all of your credit cards except for the one with the lowest balance. Take any extra money. Consider setting up automatic transfers to your savings account every payday. That way, you can put aside money for your card payments before you have a chance. Falling behind on your payments can leave a lasting, negative impact on your credit. That's why the Consumer Financial Protection Bureau recommends reaching out. 5 Steps To Assess Your Spending · Commit to a Payment Amount · Choose a Payment Strategy · Consider Balance Transfer Credit Cards · Research Debt Consolidation. Step 1: Face credit card debt head-on · Step 2: Set a motivating goal · Step 3: Draft your spending plan · Step 4: Focus on credit card debt repayment · Step 5. This will keep the payment history portion of your FICO score in good brianladd.online you can afford to pay of your debt quickly, do it! Not only will it improve. 1. Set a Goal Start by Setting a Goal You Can Achieve · 2. Put Your Credit Cards on Ice Yes, We Mean That Literally · 3. Prioritize Your Debts · 4. Trim Your. If you're having trouble keeping up with your minimum monthly payments, consider looking into credit counseling. The National Foundation for Credit Counseling . With the debt snowball method, you start by knocking out your lowest debt balance while making the minimum monthly payment on everything else. After you pay off.

Real Estate Crowdsourcing

Real estate crowdfunding is a method of funding a real estate project using a small amount of funds from a large number of investors. How To Crowdfund Your Real Estate Purchase. couple looking at computer. Can't afford that down payment? Try crowdfunding for your new pad. Real estate crowdfunding allows retail investors to invest in property through fractional equity investments or making loans without buying a building. Fundrise is a real estate crowdsourcing platform. Fundrise offers both commercial and residential real estate investment opportunities that aren't available to. Philanthropy and civic projects · Real estate · Intellectual property exposure · Science · Journalism · International development · Legal. SmartCrowd allows you to start investing in Dubai's booming property market, build your own rewarding real estate portfolio, generate a passive income, and. Real estate crowdsourcing allows you to be more flexible in your real estate investments by investing beyond just where you live for the best returns possible. Here's a “cheat sheet” table comparing eight of the best real estate crowdfunding platforms in — at least the ones that allow middle-class investors. Much like mutual funds, a variety of different investment vehicles have been created for the real estate crowd investor. With the proper research and work, real. Real estate crowdfunding is a method of funding a real estate project using a small amount of funds from a large number of investors. How To Crowdfund Your Real Estate Purchase. couple looking at computer. Can't afford that down payment? Try crowdfunding for your new pad. Real estate crowdfunding allows retail investors to invest in property through fractional equity investments or making loans without buying a building. Fundrise is a real estate crowdsourcing platform. Fundrise offers both commercial and residential real estate investment opportunities that aren't available to. Philanthropy and civic projects · Real estate · Intellectual property exposure · Science · Journalism · International development · Legal. SmartCrowd allows you to start investing in Dubai's booming property market, build your own rewarding real estate portfolio, generate a passive income, and. Real estate crowdsourcing allows you to be more flexible in your real estate investments by investing beyond just where you live for the best returns possible. Here's a “cheat sheet” table comparing eight of the best real estate crowdfunding platforms in — at least the ones that allow middle-class investors. Much like mutual funds, a variety of different investment vehicles have been created for the real estate crowd investor. With the proper research and work, real.

RealtyMogul simplifies commercial real estate investing. Explore select real estate opportunities. Go beyond stocks and bonds. In a time of high inflation, interest rates, and limited access to the traditional property market, property crowdfunding opens doors for more people to invest. Arrived is a platform for easily investing in Real Estate, starting from $ Invest in rental properties, earn passive income, and let Arrived take care. Crowd,” and NSSC Funding Portal, LLC, which we refer to as “NSSC Funding Portal.” NSSC Crowd offers investments in real estate projects under Rule (c) of. RealtyMogul's team of real estate professionals search the US to find compelling investment opportunities with different levels of risk-adjusted returns. Hello!I'm in the process of learning about crowdfunding as a real estate investment option - to invest my money - for brianladd.online is your favorite re. Real Estate Crowdfunding: How Our Model Differs · Sponsors – Capital that is raised goes to the real estate developer or sponsor. · Individual investors – These. For the real estate investing crowd, what are your thoughts on FUNDRISE and/or HERE? Do you view it as poor man's real estate investing? Brikkapp is your one-stop-shop for real estate crowdfunding. Find and compare investments worldwide from as low as € Equity investing is the most common form of crowdfunded real estate deal. With this investment type, investors are shareholders in a specific property or. The best Real estate crowdfunding platforms · Rendity · Crowdestate · StockCrowd IN · Urbanitae · Inrento · dagobertinvest · Walliance · CITESIA. Real estate crowdfunding platforms have opened the door for investors to pool their resources for property investments, making it easier for all types of. Real estate crowdfunding has democratized investing in property, and allows smaller players to invest alongside the biggest ones, often on the same terms. The digital platform that makes real estate investing accessible and transparent to the public. Our carefully selected real estate projects offer you the. The top real estate crowdfunding sites are Fundrise, CrowdStreet, and RealtyMogul. When investing, stick with the best platforms. Over nearly a decade, Crowdestate has become Europe's leading real estate crowdfunding platform, delivering average returns of % per annum and protecting. With real estate crowdfunding, the initial investment is low compared to the hundreds of thousands of dollars it traditionally costs to own property. Real estate crowdfunding is an investment avenue that uses crowdfunding or sourcing capital from a “crowd” of investors, to raise money for investments in real. addy is disrupting the real-estate investing world. Anyone can invest in the market with addy. It allows people to invest small amount of money in great. With real estate crowdfunding, you don't need to be a professional investor to invest. This enables a wider group of people who want to invest in property but.

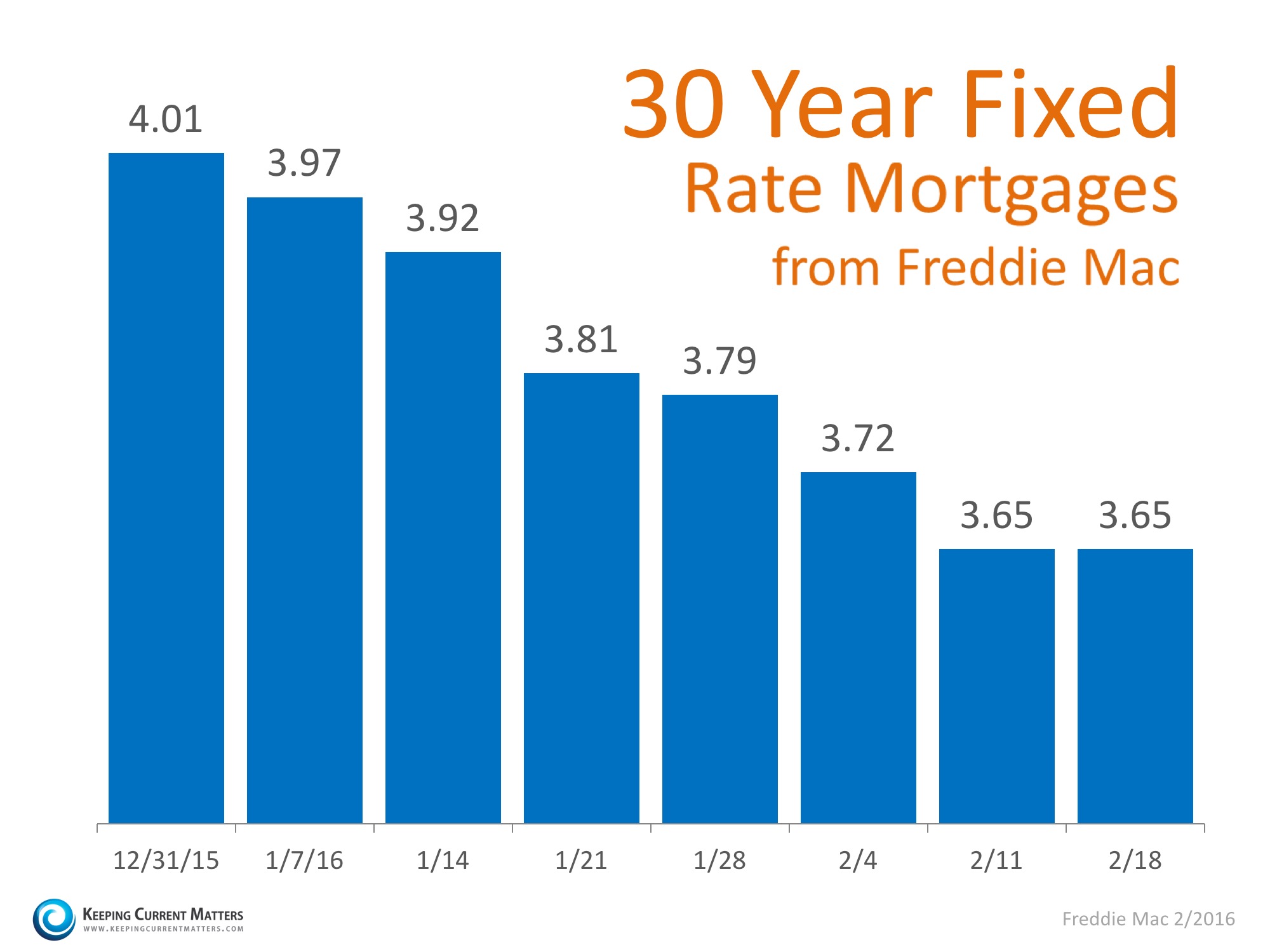

Current Refinance Rates Az

The average Arizona mortgage rate for a fixed-rate year mortgage is % (Zillow, Jan. ). Arizona Jumbo Loan Rates. In most counties, a home loan that's. Compare today's refinance rates ; Star One Credit Union. 30 year fixed refinance. Points: 0. %. 30 year fixed refinance. % ; San Diego County Credit. The current average year fixed mortgage rate in Arizona remained stable at %. Arizona mortgage rates today are 2 basis points higher than the national. Current Arizona fixed rate mortgages for a 30 Year Fixed mortgage are at % with % point(s), Current Arizona fixed rate mortgages for a 30 Year. Eligibility For Lower Refinance Interest Rates. Our goal at KHoward Mortgage Team is to help families fully enjoy the home of their dreams, at the lowest rates. The current mortgage rates in Arizona stand at % for a year fixed mortgage and % for a year fixed mortgage as of July 30 pm EST. Today's mortgage rates in Phoenix, AZ are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Current 30 year-fixed mortgage rates are averaging: % Current average rates are calculated using all conditional loan offers presented to consumers. Get the latest mortgage rates for purchase or refinance from reputable lenders at brianladd.online®. Simply enter your home location, property value and loan amount. The average Arizona mortgage rate for a fixed-rate year mortgage is % (Zillow, Jan. ). Arizona Jumbo Loan Rates. In most counties, a home loan that's. Compare today's refinance rates ; Star One Credit Union. 30 year fixed refinance. Points: 0. %. 30 year fixed refinance. % ; San Diego County Credit. The current average year fixed mortgage rate in Arizona remained stable at %. Arizona mortgage rates today are 2 basis points higher than the national. Current Arizona fixed rate mortgages for a 30 Year Fixed mortgage are at % with % point(s), Current Arizona fixed rate mortgages for a 30 Year. Eligibility For Lower Refinance Interest Rates. Our goal at KHoward Mortgage Team is to help families fully enjoy the home of their dreams, at the lowest rates. The current mortgage rates in Arizona stand at % for a year fixed mortgage and % for a year fixed mortgage as of July 30 pm EST. Today's mortgage rates in Phoenix, AZ are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Current 30 year-fixed mortgage rates are averaging: % Current average rates are calculated using all conditional loan offers presented to consumers. Get the latest mortgage rates for purchase or refinance from reputable lenders at brianladd.online®. Simply enter your home location, property value and loan amount.

Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. Find the best mortgage rates in Arizona using the HSH Lender Showcase to customize your results. Compare offers from multiple lenders on the spot. Looking for low refinance rates or Mortgage rates today in Arizona? Check out our Mortgage Calculator to find a Mortgage that fits your budget. According to data from CoreLogic, the average property value in Arizona is $, and the average mortgage balance $, This means many homeowners. The rate for year fixed loans is just % as of Aug. 10, and the rate for year fixed loans is %. Current Mortgage Rates: 15 Year Fixed* % (% APR) Apply Now 30 Year Fixed* % (% APR) Apply Now. Use our mortgage rate tool to compare mortgage quotes with current rates from our participating mortgage lenders in San Francisco, CA. The current average year fixed refinance rate was stable at %. Arizona's rate of % is 16 basis points lower than the national average of %. Mortgage Rates in Arizona ; Mutual of Omaha Mortgage, Inc. NMLS # · % ; Rocket Mortgage. NMLS # · % ; PenFed Credit Union. NMLS # · %. Additionally, Arizona refinance rates are typically lower than the national averages, which means you can save money when refinancing your home. Closing costs. Compare Arizona mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Looking for home mortgage rates in Arizona? View loan interest rates from local banks, AZ credit unions and brokers. Phoenix, AZ Mortgage Rates · Phoenix mortgage rate trends · August 30, · % · % · % · Mortgage tools · Mortgage tips · Mortgage Rates by State. Overview of the Arizona Housing Market ; 7/1 ARM refi, %, %, ; 15 yr jumbo fixed mtg refi, %, %, AZFCU has the mortgage for you. Looking for a FHA Loan, VA Loan or first time home buyer option? Our low refinance rates and mortgage rates make it easy. The average Arizona mortgage rate for a fixed-rate year mortgage is % (Zillow, Jan. ). Arizona Jumbo Loan Rates. In most counties, a home loan that's. Rate buydown options available! Click here to calculate savings! Price Mortgage Toggle navigation Current Mortgage Rates. Compare our current interest rates ; FHA loan, %, %, ($), $ ; VA loans, %, %, ($), $ Floor Rate: %, Lifetime cap: %. Min. Payment: You will be required to make payments during draw period (10 years) and repayment period (up to 15 years). While Arizona's climate may not appeal to everyone, the state does offer mild home prices and a low property tax rate.

Who Makes The Jitterbug Smartphone

Shop Lively® Jitterbug Smart4 Smartphone for Seniors Black at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. Alcatel Jitterbug Smart2 This phone aimed at older users defaults to a simplified interface with large text, on a large screen, but is also a smartphone that. Lively cell phones from the makers of Jitterbug are designed to be easy to see and hear, simple to use, affordable, and to help improve the lives of. Jitterbug Smart 3 promises ease into smartphone life for seniors. It's uncomplicated and reasonably affordable, but does it stand out compared to other. Greatcall Jitterbug Smart2 Smartphone for Seniors Review Our content is free because we may earn a commission when you click or make a purchase using our site. Jitterbug phones have a dedicated button to Urgent Response Service, which makes sure that whatever the emergency is, you can have access to a medical expert. Jitterbug's parent company Lively has wearable medical alert devices that can help you stay safe while you run errands, go on vacation, or hang out at home. The. GreatCall, the manufacturer of the Jitterbug, has a 24/7 operator service that can help you place calls and manage your phone book. This is different from the. The Jitterbug Flip2 makes life easier. Our Care Advisors are always available if you have a question. And with its big buttons and powerful speaker. Shop Lively® Jitterbug Smart4 Smartphone for Seniors Black at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. Alcatel Jitterbug Smart2 This phone aimed at older users defaults to a simplified interface with large text, on a large screen, but is also a smartphone that. Lively cell phones from the makers of Jitterbug are designed to be easy to see and hear, simple to use, affordable, and to help improve the lives of. Jitterbug Smart 3 promises ease into smartphone life for seniors. It's uncomplicated and reasonably affordable, but does it stand out compared to other. Greatcall Jitterbug Smart2 Smartphone for Seniors Review Our content is free because we may earn a commission when you click or make a purchase using our site. Jitterbug phones have a dedicated button to Urgent Response Service, which makes sure that whatever the emergency is, you can have access to a medical expert. Jitterbug's parent company Lively has wearable medical alert devices that can help you stay safe while you run errands, go on vacation, or hang out at home. The. GreatCall, the manufacturer of the Jitterbug, has a 24/7 operator service that can help you place calls and manage your phone book. This is different from the. The Jitterbug Flip2 makes life easier. Our Care Advisors are always available if you have a question. And with its big buttons and powerful speaker.

See New item Jitterbug Smart The new Jitterbug Touch3 is the smartphone with built-in apps that can help improve your daily life and well-being. Makes writing emails and texts effortless Mobile Internet Access Access the In. New Jitterbug Smart Easy-to-Use ” Smartphone for Seniors GreatCall. Save Big on Jitterbug Cell Phones & Smartphones and choose from a variety of colors like Red, Gray, Black to match your style. Shop our extensive inventory. If you want Mint, which has significantly better rate plans than the Jitterbug plans from GreatCall, you'll need to find a comparable unlocked. Item No. The Jitterbug Smart3 is designed with seniors in mind. Everything from texting, emailing, getting directions and browsing the internet is. Shop Jitterbug Smartphone for Seniors Verizon · Brand · Price · Internal Storage · Display Size · Operating System · Cell Phone Type · Lock Status. Get yours today at Target! Whatever your favorite brand, we've got it, including Nokia, Blackberry, HTC, Virgin, Samsung, LG and Motorola. Looking for cell. Shop Lively® Jitterbug Smart3 Smartphone for Seniors Black at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. The Jitterbug Smart4 is designed, first and foremost, to be a simple, affordable smartphone for seniors. However, that certainly does not mean that it lacks. Shop Jitterbug Smart3 Smartphone for Seniors and read reviews at Walgreens. View the latest deals on Lively Personal Care Aids. Buy LIVELY Jitterbug Smart4 Smartphone for Seniors - Cell Phone for Seniors - Not Compatible with Other Wireless Carriers - Must Be Activated Phone Plan. The body of the phone is almost entirely made of black and gray plastic, and is manufactured by TCL, the same company that makes Alcatel and BlackBerry phones. Lively offers Jitterbug cell phones for seniors plus Lively medical alerts to help seniors stay safe, connected to family & healthy. LIVELY- JITTERBUG SMART3 SMARTPHONE FOR SENIORS - BLACK. And at the touch of a button, the Lively Response Team gives you access to exclusive services to. Device Manufacturer. Alcatel. Phone Style. Smartphone. Bluetooth Enabled. Yes. NFC Technology. No. Charging Interface(s). USB Type C. SIM Card Size. Nano SIM. Shop Jitterbug SMART amplified smartphone with good features for seniors from our online hearing impairment aid devices shopping store. Shop Jitterbug Smart3 Smartphone for Seniors and read reviews at Walgreens. View the latest deals on Lively Personal Care Aids. Lively's Jitterbug Smart4 is a smartphone for older adults. This phone can help you or your loved one summon help in an emergency and stay connected with. Approximately one million customers use GreatCall's services, which include two Jitterbug phone models and also wearable medical alert systems from Lively. Large " screen and simple list-based menu make it easy to see the buttons and navigate the phone. · Voice typing makes texting and emailing easy. · Long-.

What Is Defi 2.0

DeFi builds upon the foundational principles of its predecessor while addressing its pain points and introducing several transformative advancements. Backed by @consensys, @21Shares, @okx & @hofcapital. $DEFI was Founded 2/ Alternative thread heading: How 6 easy-to-get-badges can bring you a free. Creative liquidity incentive protocols are perhaps the defining feature of DeFi Emerging projects require sizable, reliable capital in order to launch and. Defi was a term coined to describe a new wave of protocols that gained popularity in late including Olympus DAO, Tokemak and Alchemix. The term has. After many years, Defi is a comeback in Crypto. Recently, we usually hear that: Defi is the future, Defi will change the financial of the world. Listed below are the top crypto coins and tokens used for DeFi They are listed in size by market capitalization. The main objective of DeFi is to resolve the limitations that are present in early generation DeFi. The second version has new innovations and solutions and. Decentralized finance (DeFi) refers to blockchain-connected platforms and applications that, in theory, can replace the existing centralized financial. To put it very simply, DeFi is the second generation of dApps that are concerned with decentralized finance. While the differences between DeFi and DeFi. DeFi builds upon the foundational principles of its predecessor while addressing its pain points and introducing several transformative advancements. Backed by @consensys, @21Shares, @okx & @hofcapital. $DEFI was Founded 2/ Alternative thread heading: How 6 easy-to-get-badges can bring you a free. Creative liquidity incentive protocols are perhaps the defining feature of DeFi Emerging projects require sizable, reliable capital in order to launch and. Defi was a term coined to describe a new wave of protocols that gained popularity in late including Olympus DAO, Tokemak and Alchemix. The term has. After many years, Defi is a comeback in Crypto. Recently, we usually hear that: Defi is the future, Defi will change the financial of the world. Listed below are the top crypto coins and tokens used for DeFi They are listed in size by market capitalization. The main objective of DeFi is to resolve the limitations that are present in early generation DeFi. The second version has new innovations and solutions and. Decentralized finance (DeFi) refers to blockchain-connected platforms and applications that, in theory, can replace the existing centralized financial. To put it very simply, DeFi is the second generation of dApps that are concerned with decentralized finance. While the differences between DeFi and DeFi.

What is DeFi ? DeFi is the evolution of the first decentralized financial industry. It aims to address the limitations and solve the. DeFi promotes interoperability through cross-chain bridges and composability, allowing for seamless asset exchange and enabling new financial primitives. In. Your gateway to DeFi. ✓ Track your wallet's crypto assets across zkSync Era is a Layer-2 protocol that scales Ethereum with cutting-edge ZK tech. The DeFi ecosystem uses a layered architecture and highly composable building blocks. While some applications promote high interest rates, they are subject to. DeFi is an improved version of the DeFi ecosystem that resolves its flaws & build on its strengths, offering financial freedom to the people using DeFi. DeFi vs. DeFi · DeFi offers investors another means of earning income and rewards without worrying about price volatility. · The vision of these. DeFi is a collective term for all the protocols and projects created for the blockchain, solving problems or mistakes of previous DeFi. DeFi is the new and improved version of decentralized finance apps that aims at helping businesses instead of just individual users. They utilize the. Your gateway to DeFi. ✓ Track your wallet's crypto assets across zkSync Era is a Layer-2 protocol that scales Ethereum with cutting-edge ZK tech. The goal of this piece is to put DeFi in the context of Web3 more generally from to We'll spend sections I, II, and III on context, and then. DeFi is shaping the future by addressing the limitations of scalability, security, and usability present in traditional DeFi, making it more accessible and. Defi is a better version of the Defi model, aiming to leverage strengths to provide consumers with new and exciting options. Decentralized finance (DeFi) refers to blockchain-connected platforms and applications that, in theory, can replace the existing centralized financial. Protocol-owned liquidity (POL) is one of a few key innovations of the DeFi narrative. The protocol behind this invention is Olympus DAO. Protocol-owned. DeFi is an upgraded version of DeFi attempting to fix the existing weaknesses and leverage the strengths of the current DeFi, which can open even more. A Closer Look at the Top DeFi Projects · 1. Pepe Unchained – Overall Best DeFi Meme Coin · 2. Crypto All-Stars – Stake Multiple Meme Tokens, Get Up to. DeFi marks a remarkable advancement in the decentralized finance landscape, introducing game-changing features that address the. DEFI [DEFI] is a token based on Binance Coin blockchain. The most actual price for one DEFI [DEFI] is $0. DEFI is listed on 0 exchanges with a sum. DeFi is a movement that aims to revolutionize the way we use cryptocurrency and decentralized finance (DeFi). Backed by @consensys, @21Shares, @okx & @hofcapital. $DEFI was Founded 2/ Alternative thread heading: How 6 easy-to-get-badges can bring you a free.

What Can I Do Online To Make Money Daily

4. How can I earn extra income from home? Earning extra money from home can be achieved through part-time remote work, freelancing, or launching a side hustle. Selling online · Sell on Amazon · Fulfillment by Amazon · Amazon Advantage · Advertising online · Amazon Display Ads · Amazon Associates · Amazon Sponsored Products. 15 Apps To Make Money Online DAILY Within 24 Hours · OnMyWay · ReceiptJar · Surveys On The Go · MooMoo · BeMyEyes · GameHag · 9. You can generate income online by designing and selling your customized merchandise on another print-on-demand website. This platform enables you to create. If you need to make money quickly online, try Fiverr or Upwork. Many people have earned money there by offering services like writing, graphic. You can collect your free money online in the most convenient way for you! Frequently Asked Questions. How do I get free money right now? Which apps. Freelance Gigs: Offer quick tasks on platforms like Fiverr or Upwork. Online Surveys: Complete surveys on sites like Swagbucks or Survey Junkie. day. To do the math for you, if you were to watch the daily ads and check in every day at the end of the month you would have accumulated 2, points. So. Moreover, you also have the option to complete online surveys or test websites/mobile apps to earn some cash quickly. 2. How can I make $ per day on the. 4. How can I earn extra income from home? Earning extra money from home can be achieved through part-time remote work, freelancing, or launching a side hustle. Selling online · Sell on Amazon · Fulfillment by Amazon · Amazon Advantage · Advertising online · Amazon Display Ads · Amazon Associates · Amazon Sponsored Products. 15 Apps To Make Money Online DAILY Within 24 Hours · OnMyWay · ReceiptJar · Surveys On The Go · MooMoo · BeMyEyes · GameHag · 9. You can generate income online by designing and selling your customized merchandise on another print-on-demand website. This platform enables you to create. If you need to make money quickly online, try Fiverr or Upwork. Many people have earned money there by offering services like writing, graphic. You can collect your free money online in the most convenient way for you! Frequently Asked Questions. How do I get free money right now? Which apps. Freelance Gigs: Offer quick tasks on platforms like Fiverr or Upwork. Online Surveys: Complete surveys on sites like Swagbucks or Survey Junkie. day. To do the math for you, if you were to watch the daily ads and check in every day at the end of the month you would have accumulated 2, points. So. Moreover, you also have the option to complete online surveys or test websites/mobile apps to earn some cash quickly. 2. How can I make $ per day on the.

Do Data Entry Work: $/Month. If you're good with computers and have some basic typing skills, then you can make money online by doing data input work. Do Data Entry Work: $/Month. If you're good with computers and have some basic typing skills, then you can make money online by doing data input work. online or do both. Anyone over 16 who lives in Several companies put problems online and offer cash to people who can come up with effective solutions. 19+ Best Online Jobs That Pay Daily. Survey Sites; Online Games; Editing or Proofreading; Virtual Assistant; Mobile Apps; Freelance Writing; Selling Online. If you're able-bodied and willing, making money as a mover can be a great avenue to earn supplemental income. Take a look at your local classifieds or job. I've discovered 32 websites that will pay you every single day. Now, most of these websites require zero experience and you can even use them for free. Earn extra cash by doing microtasks like comparing images or rating search results. You can do it from anywhere, whether you're on the go or relaxing at home. Affiliate marketing is the best way for anyone to start earning money online. This requires zero investment & you can use your blog or even your social media. The clickworker app displays appropriate jobs for you, so you can quickly get an overview of the available work and get busy earning money. Clickworker App. The fastest way to make quick cash without doing anything is to take surveys online. You will be required to answer a few questions to qualify for payment. Swagbucks – Earn up to $35 a survey with this mega-popular app, and get a $10 bonus just for signing up! Survey Junkie – Take 3 surveys a day and earn up to. How it works: Do you have a lot of nice stuff that you think people in your neighborhood would want to rent out? For instance, maybe you have an expensive. Think about where your strengths and skills lie: Is it coding? Then you might consider building an app. Do you know how to reach out to people and coalesce them. Welcome to Repocket — the best passive income app you'll ever come across. Repocket helps you earn by sharing your internet connection, allowing you to. OwoDaily lets you earn money by completing micro-jobs, participating in reward bounties, and taking advantage of cashback offers. Our user-friendly platform. Paidwork is a full time or additional job for all people, from every country. You can earn money on any device with access to the internet, wherever you are. To start making money with online surveys, sign-up with Swagbucks, verify your email address and complete your profile. With our new mobile app, you can. IMPORTANT NOTICE! TOLOKA APPLICATION IS NOT DESIGNED FOR TOLOKA ANNOTATORS PLATFORM USERS. PLEASE DO NOT DOWNLOAD *** Toloka is an app for earning money. Online earning site Gift Hunter Club doles out points for watching videos, doing polls, entering competitions and completing other easy tasks. You can convert. Technically you can make money instantly, using services where you have to do actions or sign up to websites to get paid. Nothing wrong with this, however.

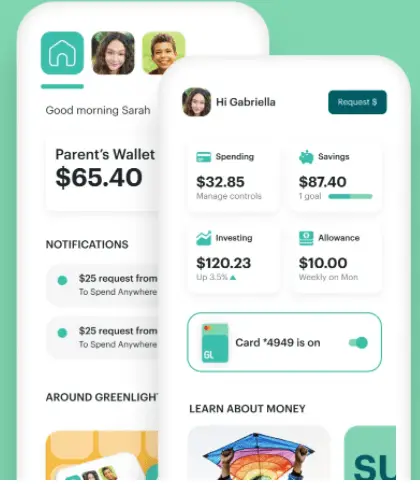

Greenlight Debit Card App

With the Greenlight debit card and app from GSB, parents set flexible controls and get real-time notifications every time their kids spend money. See Greenlight terms for details. Offer ends 04/27/ Offer subject to change. The Greenlight card is issued by Community Federal Savings Bank, member FDIC. It's time to get the app to unlock everything Greenlight has to offer. How? Scan the QR code with your phone's camera. You'll be directed to the app store. Greenlight's app and debit card equips parents with a convenient and accessible way to teach their children financial responsibility through hands-on. Greenlight is the family online banking app¹ where you learn to earn, save, and invest together. Join 6+ million parents & kids learning about money and. Greenlight debit cards are FDIC-insured up to $, and come with Mastercard's Zero Liability Protection. Greenlight blocks 'unsafe' spending categories. Use the QR code above to download the Greenlight app on their device. Then, they can log in with the credentials you just set up. Greenlight Debit Card Partner Offer. Greenlight Debit Card. See Terms. Apply now at Greenlight's secure site. Greenlight is the award-winning money app and debit card that empowers parents to raise financially smart kids. Kids and teens learn to earn, save, and spend. With the Greenlight debit card and app from GSB, parents set flexible controls and get real-time notifications every time their kids spend money. See Greenlight terms for details. Offer ends 04/27/ Offer subject to change. The Greenlight card is issued by Community Federal Savings Bank, member FDIC. It's time to get the app to unlock everything Greenlight has to offer. How? Scan the QR code with your phone's camera. You'll be directed to the app store. Greenlight's app and debit card equips parents with a convenient and accessible way to teach their children financial responsibility through hands-on. Greenlight is the family online banking app¹ where you learn to earn, save, and invest together. Join 6+ million parents & kids learning about money and. Greenlight debit cards are FDIC-insured up to $, and come with Mastercard's Zero Liability Protection. Greenlight blocks 'unsafe' spending categories. Use the QR code above to download the Greenlight app on their device. Then, they can log in with the credentials you just set up. Greenlight Debit Card Partner Offer. Greenlight Debit Card. See Terms. Apply now at Greenlight's secure site. Greenlight is the award-winning money app and debit card that empowers parents to raise financially smart kids. Kids and teens learn to earn, save, and spend.

Get started today in four easy steps: · Register at brianladd.online · Enter your phone number and connect your WaFd Checking account · Download the. GET GREENLIGHT, THE DEBIT CARD AND MONEY APP FOR KIDS, ON US. With the Greenlight debit card and app, kids earn money through chores, set savings goals, and. Greenlight: The all-in-one debit card and money app for families. Free* for Greenlight debit cards are also covered by Mastercard's Zero Liability. The Greenlight service is a financial education app and debit card 1 for kids and teens that allows parents to instantly send their kids money. Greenlight Core: Debit card and educational app for kids and teens to earn, save, spend, and give — plus 2% on savings² ($/month.) WE'RE HERE FOR YOU. . Greenlight's debit card for kids empowers parents to teach trade-off decisions, money management, and the power of saving and investing – in one app. Greenlight is the perfect app for young children, developing teens, or others that are taking their first steps towards financial literacy. Greenlight is free. Yes, it's a debit card for kids, managed by parents. But it's also a powerful mobile app that lets parents easily manage and see where, when, and how much kids. Greenlight is a debit card for kids, not a credit card. Parents load money onto the card from their own funding source connected through their Greenlight app. Greenlight is an all-in-one money app for families. A fun and educational experience helping kids to learn money management, debit cards and saving for the. Greenlight is a debit card and money app for families, managed by parents. Greenlight gives parents the tools to manage and monitor spending as well as pay. We've partnered with Greenlight to offer members an exclusive, complimentary* subscription to their best-in-class debit card and money app for kids and teens. The Debit Card for Kids and Teens that parents manage through an app. Greenlight is a debit card for kids managed by the parents through a mobile app to teach your kids about financial responsibility. Set your child's secure PIN, and change it at any time within the app. See the online credit card applications for details about the terms and conditions of an. ¹Greenlight is a financial technology company, not a bank. The Greenlight app facilitates banking services through Community Federal Savings Bank (CFSB), Member. Greenlight debit cards are FDIC-insured up to $, and come with Mastercard's Zero Liability Protection. Greenlight sends real-time transaction. The company provides an online banking app equipped with educational resources. Greenlight also offers debit cards via Mastercard to children with a variety of. The Greenlight service is a financial education app and debit card 1 for kids and teens that allows parents to instantly send their kids money, set up chores. Download apps by Greenlight Financial Technology, Inc., including Greenlight Kids & Teen Banking.

Cash Back Refinance

Until a home appraisal is completed, your cash-out refi loan amount is just an estimate. If your appraisal comes back lower than expected, you may not qualify. A Cash-Out Refinance (often called a Cash-Out Refi) is a mortgage option that allows homeowners to borrow against the equity in their property. Using a cash-out refinance to consolidate debt increases your mortgage debt, reduces equity, and extends the term on shorter-term debt and secures such debts. back control of your financial life. Rocket Homes. Get a real estate agent handpicked for you and search the latest home listings. Rocket Mortgage. Buy A Home. refinance rather than the borrower receiving cash back. Can I Refinance Without Closing Costs? As with any other home loan, you do pay closing costs for a. We will pay you up to $10, cash when you purchase a home or refinance with us. If you are an owner/occupier or an investor you will receive a minimum of. Borrowers don't always know that getting a small amount of cash back is possible on a rate-and-term refinance, and lenders don't always ask. The result? back. Cash-Out Refinance Rates. If you compare a rate and term refinance to a cash-out, you will see that the refinance rates can be slightly higher. Compare. Once you've calculated your payment amount, take some time to compare cash-out refinance offers from multiple lenders. Back to calculator. Cash-out refinance. Until a home appraisal is completed, your cash-out refi loan amount is just an estimate. If your appraisal comes back lower than expected, you may not qualify. A Cash-Out Refinance (often called a Cash-Out Refi) is a mortgage option that allows homeowners to borrow against the equity in their property. Using a cash-out refinance to consolidate debt increases your mortgage debt, reduces equity, and extends the term on shorter-term debt and secures such debts. back control of your financial life. Rocket Homes. Get a real estate agent handpicked for you and search the latest home listings. Rocket Mortgage. Buy A Home. refinance rather than the borrower receiving cash back. Can I Refinance Without Closing Costs? As with any other home loan, you do pay closing costs for a. We will pay you up to $10, cash when you purchase a home or refinance with us. If you are an owner/occupier or an investor you will receive a minimum of. Borrowers don't always know that getting a small amount of cash back is possible on a rate-and-term refinance, and lenders don't always ask. The result? back. Cash-Out Refinance Rates. If you compare a rate and term refinance to a cash-out, you will see that the refinance rates can be slightly higher. Compare. Once you've calculated your payment amount, take some time to compare cash-out refinance offers from multiple lenders. Back to calculator. Cash-out refinance.

Claim $2, cashback++ for refinanced loans of $, or more, with a loan-to-value ratio of less than or equal to 80%. Available on owner-occupied and. Refinancing cashback offers are very common in the market. In saying that, sometimes you can get cashback as a new home buyer, too. But it's less common. See. Apply for a cash-out mortgage refinance from UW Credit Union to get the cash you need for a variety of big expenses. Earn %* Cash Back Bonus When you refinance your auto loan with IU Credit Union! Refinancing your auto loan is quick, easy and could save you a lot of money. A cash out refinance can help you pay for home upgrades, education, and help you consolidate high-interest debt. back along with the balance of the loan. Q: Does Texas allow cash-out refinance? A: Yes. However, cash-out refinances work differently than they do in other. a lower interest rate (APR); a lower monthly payment; a shorter payoff term; eliminate private mortgage insurance (PMI); the ability to cash out your equity for. Navy Federal Credit Union shares how a cash-out refinance affects your mortgage balance, how it differs from a home equity loan or line of credit and when. Cash-Out Refinance Requirements. Back to Top. The requirements for eligibility for Cash-Out Refinance vary based on your individual lender. Each mortgage. Get up to $3, cashback^ when you apply for a new purchase or refinance online. Apply online. ^T&Cs and eligibility criteria apply. Online home loans with. Guide · Guide Home · Seller/Servicer Relationship · Selling · Servicing. Back A “no cash-out” refinance Mortgage must meet the Borrower requirements in. A cash-out refinance loan can be a good idea if you'll get a lower interest rate and you'll use the cash for college expenses or home repairs. A cash-out refinance loan — AKA a cash-out refi — is when you refinance your back to you within one business day. Learn more. learninghomelending. Hi all, Just wondering if it is worth taking advantage of cashback offers for refinancing my home loan? I have sub $k remaining on my. Only 12 lenders now offer cashback deals, which is down from the 35 offers available in March , according to RateCity figures. You'll receive your lump-sum payment after closing, and you can start using your funds 3-days after you close. Back to side 1 of 2. Payments & rates. Side 1. Cash-out refinance requirements. Think back to when you first applied for a mortgage. Your lender looked at your credit score, debt-to-income ratio (DTI). A cash-out refinance is a mortgage refinancing option in which an You start paying back the principal plus interest when the repayment period kicks in. A home equity line of credit (HELOC), is a credit-line secured by your home whereas a cash-out refinance is an entirely new first mortgage with cash back. Most. A $3, cash back offer is available on refinances of an existing home loan from another financial institution with a minimum new lending of $, and a.